Supplier Segmentation Guide for Supply Chain Resilience

Managing suppliers effectively is essential for a strong and reliable supply chain. But how do you know which suppliers need the most focus? This article explores how supplier segmentation helps you organize and prioritize suppliers strategically.

What is supplier segmentation?

Supplier segmentation is a supplier performance management technique that organizes suppliers into tiers based on their importance to your business. Not all suppliers are the same. Some supply essential parts that are hard to replace, while others provide items that are easy to acquire from different sources. Grouping suppliers by factors like importance, risk, and cost enables managing each group of suppliers better and using resources where they matter most.

Common supplier categories include:

- Strategic or Fringe suppliers are essential, hard-to-replace suppliers that your company depends on. They might supply sub-assemblies or have a long-term, specialized supply relationship with your company. Effective partnership with them directly impacts your business.

- Tactical suppliers are important based on current needs or in a time-bound way. For example, they may be critical for a large order or seasonally but aren’t necessarily strategic partners and can be replaced later.

- Leverage suppliers. These suppliers provide commodities that there’s a lot of supply for on the market. They are easier to replace, and they know it, which means you can often negotiate better prices with them.

- Bottleneck suppliers. These suppliers provide specialized items that are critical to your operation but hard to find. Problems with them could cause delays in production. Always keep an eye out for extra bottleneck suppliers.

- Non-critical suppliers. These suppliers provide low-risk items that are easy to replace and won’t cause major disruptions.

Suppliers can be further grouped by location, industry, or sustainability. For example, if cutting costs is important, focus on leveraging suppliers for better deals. If sustainability is a goal, you might group eco-friendly suppliers together.

Why is supplier segmentation important?

Supplier segmentation is essential because it allows you to focus on managing the suppliers most critical to your business. By categorizing suppliers based on criticality to your operations, you can prioritize building stronger supplier relationships and take a proactive approach to managing supplier risks.

For businesses with complex production processes or large supplier bases, segmentation helps quickly identify which suppliers are essential and which are easier to replace. It also supports spend analysis by highlighting where to negotiate with leverage suppliers and secure long-term contracts with strategic ones. In addition, effective supplier segmentation helps reduce risk by ensuring that critical suppliers receive needed attention while routine suppliers are managed efficiently.

Supplier segmentation strategies and techniques

Next, let’s go over simple but tested methods for implementing a supplier segmentation process.

The Kraljic Matrix

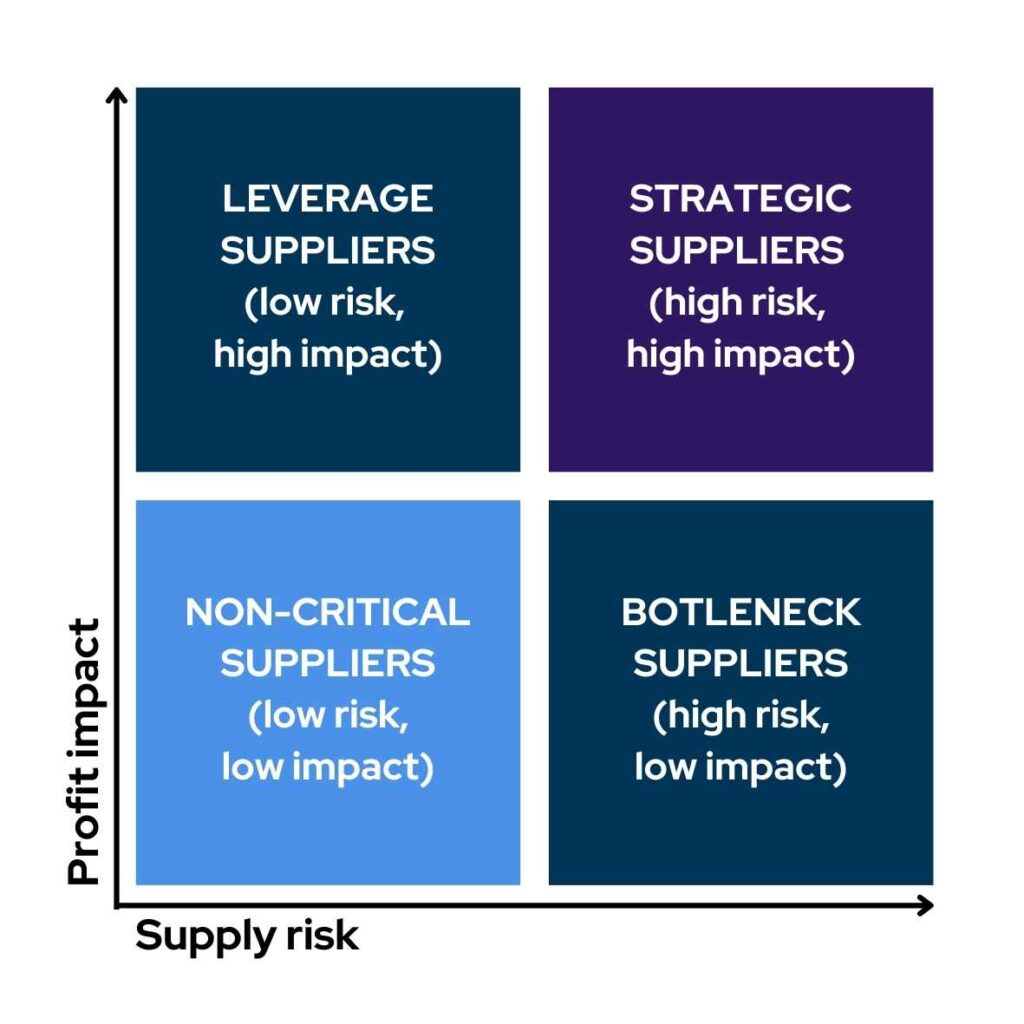

The Kraljic Matrix is a tool for organizing suppliers based on the criticality of their supplies to your business. It’s named after Peter Kraljic, who created it to help businesses simplify procurement management based on two main factors.

- Supply risk determines the level of risks associated with securing these supplies. The more uncertainty involved in the market, the less replaceable the item, or the more market monopoly a supplier holds, the higher the supply risk.

- Profit impact indicates the importance of items to your operation and how much they affect your bottom line. Things like item quality, cost savings from purchase terms, and the price of the items are taken into account.

Based on your available suppliers, the matrix enables dividing them into four quadrants:

1. Leverage suppliers (Low risk, high impact). These are suppliers whose products have a big effect on your business but are easy to find. You should negotiate better terms with suppliers who fall into this quadrant.

2. Strategic suppliers (High risk, high impact). These suppliers are vital to your business and hard to replace, so building strong, reliable relationships with them is important.

3. Bottleneck suppliers (High risk, low impact). These suppliers provide unique items that are hard to source, but their impact on your profits is smaller. Focus on minimizing risks with them.

4. Non-critical suppliers (Low risk, low impact). These suppliers provide low-impact, easy-to-replace products. They don’t need much attention or resources.

By understanding which suppliers fall into each quadrant, you can make better decisions about where to focus your resources. You can prioritize supplier relationship management and reduce risks in supply chain management.

The Pyramid Approach

The Pyramid Approach is a method for categorizing suppliers based on their strategic importance to your business. This technique organizes suppliers into tiers, with each tier representing a different level of importance. The suppliers at the top are the most critical to your operations, while those at the base are less crucial and more easily replaced.

The pyramid tiers are as follows:

- Tier 1: Strategic suppliers (top of the pyramid). These are your most important suppliers and are often considered business partners. They provide high-value, unique, or essential components that are difficult or impossible to source elsewhere.

- Tier 2: Preferred suppliers (middle of the pyramid). These suppliers are important but not as critical as those in Tier 1. They provide significant value, but they are more replaceable than strategic suppliers.

- Tier 3: Approved suppliers (base of the pyramid). These are your regular, reliable suppliers who provide routine or low-value items. They are easily replaceable, and your relationship with them is primarily transactional.

The pyramid approach helps you focus your resources, including your time, money, and attention, based on the importance of the suppliers to your operation. It ensures that critical suppliers receive the attention and resources needed to meet your standards consistently. At the same time, it helps streamline transactions with low-impact suppliers to control costs.

Other supplier segmentation methods

In addition to the Kraljic and Pyramid methods, there are other ways to segment suppliers.

ABC analysis is an inventory management method that can also be applied to supplier relationships. It segments items based on their importance to your business. ABC Analysis follows the Pareto principle, also known as the 80/20 rule. It states that 20% of suppliers typically generate 80% of value. This enables grouping suppliers into three categories:

- A-suppliers. High-value suppliers that are critical to your business and require the most attention.

- B-suppliers. Moderate-value suppliers that are important but easier to replace.

- C-suppliers. Low-value, easily replaceable suppliers that require minimal management.

This method helps you focus your resources on high-impact suppliers while automating or simplifying management for lower-priority ones.

Another option is to segment vendors based on lifecycle. Here, suppliers are segmented by the stage of their relationship with the business.

- Development suppliers work with you on new products, provide sub-assemblies, and play key roles in your manufacturing efforts. They require close collaboration.

- Core suppliers provide essential goods, and you typically have long-term, stable relationships with them.

- Tail suppliers are used for short-term or specific projects and don’t need as much attention.

Benefits of supplier segmentation

Supplier segmentation helps you optimize your supply chain by focusing on the suppliers that matter most. Here’s how your business can benefit:

- Proactive risk management. By identifying your most critical suppliers, you can take steps to prevent supply chain disruptions. Knowing which suppliers pose the highest risk allows you to put contingency plans in place, such as securing backup suppliers or increasing safety stock for essential materials.

- Stronger supplier relationships. Segmentation helps you focus on building stronger, deeper relationships with key suppliers. When you know which suppliers are vital to your business, you can invest more time in collaboration, communication, and strategic partnerships. This fosters trust and leads to improved service, reliability, and innovation over time.

- Cost optimization. Grouping suppliers based on their importance and spend allows you to leverage your purchasing power with high-value suppliers. You can negotiate better deals, secure favorable terms, and reduce procurement costs. Managing routine suppliers more efficiently through streamlined processes helps save time and money.

- Improved supplier performance. Categorizing suppliers allows you to set clear performance expectations based on their role in your supply chain. For strategic suppliers, you can focus on high standards for quality, delivery, and innovation. For routine suppliers, you can prioritize cost-efficiency and reliability. Regular supplier performance management ensures that your suppliers meet your standards or are replaced by those who do.

Best practices for supplier segmentation

Supplier segmentation can be a powerful tool if implemented correctly. Here’s what to keep in mind when segmenting suppliers.

- Choose the right criteria. Successful supplier segmentation starts with picking the right factors for your business. Common factors include how much you spend, the risks involved, how essential they are, and their performance.

- Regularly review and update. Suppliers and market conditions change, so your segmentation should too. Regular reviews (either quarterly or yearly) keep your segmentation accurate. Adjust based on performance, risk, and business shifts.

- Involve multiple teams. Segmentation shouldn’t just be the job of procurement. Including other teams, such as production, finance, and R&D, can give a fuller picture of a supplier’s impact.

- Think long-term. Don’t only think about immediate needs. Consider how a supplier’s role could grow with your business. A supplier that isn’t critical today might become essential in the future.

- Leverage procurement software. Procurement software addresses key aspects of supplier management, helping to improve efficiency, reduce errors, and automate large parts of the procurement process.

When should you opt for supplier segmentation?

If your supplier base is large or growing, segmentation helps you manage each supplier relationship without overwhelming your resources. Segmentation lets you focus more time and effort on the suppliers who have the greatest impact on your business while streamlining interactions with those who are less critical. Also, as your business grows, so may your list of suppliers. Segmentation provides the structure you need to manage your suppliers effectively.

Segmentation is also useful if you have a complex supply chain. Industries with intricate production processes, such as automotive, electronics, and pharmaceuticals, benefit from segmentation because it clarifies which suppliers are critical to keeping operations running smoothly.

If risk management is a priority, supplier segmentation can pinpoint vulnerabilities in your supply chain, especially in high-risk industries. By categorizing suppliers based on risk factors—like ease of replacement, location, and reliability—you can tailor strategies to protect against disruptions.

Key takeaways

- Supplier segmentation is a technique for categorizing suppliers based on importance, risk, and cost to optimize resource allocation and manage supplier relationships effectively.

- Types of supplier segments include strategic, tactical, leverage, bottleneck, and non-critical suppliers, each serving different roles within a company’s operations.

- A key segmentation strategy is using the Kraljic Matrix, which evaluates suppliers based on supply risk and profit impact, helping businesses identify where to focus relationship efforts and risk management.

- The Pyramid Approach enables prioritization by placing the most critical suppliers at the top for stronger relationships, with lower-impact suppliers at the base for streamlined management.

- Segmentation best practices include choosing relevant criteria, regularly updating categories, involving cross-functional teams, thinking long-term, and leveraging procurement software for efficiency.

Frequently asked questions

The four main supplier segments are strategic, leverage, bottleneck, and non-critical suppliers. Strategic suppliers are vital and hard to replace; leverage suppliers are important but widely available; bottleneck suppliers are crucial but difficult to source; and non-critical suppliers provide easily replaceable items.

Suppliers can be categorized based on their impact and risk using methods like the Kraljic Matrix or the Pyramid Approach. These frameworks assess factors like supply risk, cost, and supplier importance, allowing businesses to manage resources efficiently across different supplier types.

Effective supplier segmentation criteria include criticality to operations, risk level, cost, and supplier performance. Selecting criteria that align with business goals, such as quality or sustainability, allows for focused resource allocation and risk management across supplier relationships.

Reviewing supplier segmentation at least annually is recommended, though quarterly reviews are beneficial in rapidly changing industries. Regular updates ensure that segmentation reflects current supplier performance, market conditions, and any changes in business needs, allowing the company to stay agile and manage supplier relationships effectively.

You might also like: Manufacturing Supply Chain Management – Best Practices for SMEs