What Is Obsolete Inventory and How to Prevent It?

Next to inadequate stock levels, inventory losing its value is a key concern among companies. Capable inventory management software is your best tool for increasing stock control and thus avoiding both issues. In this post, we look at obsolete inventory – how to prevent it and what to do when it happens.

You can also listen to this article:

What is obsolete inventory?

Obsolete inventory is any inventory that a company can no longer sell or use due to lack of demand. This mostly occurs when goods reach the end of their product life cycle or in cases of sudden sales disruptions or demand forecasting mistakes. Obsolescence can also result from poor inventory management, such as when inventory items are forgotten, damaged, or expire before they’re sold or used. In these latter cases, obsolete items are usually called dead stock.

All kinds of inventory may become obsolete, not just finished products. For manufacturers, obsolete inventory can also include raw materials and components or even work-in-process (WIP) inventory because when demand dries up, items required for the production effort become obsolete.

Obsolete inventory is sometimes also referred to as excess stock or slow-moving inventory. However, these terms are slightly different. Slow-moving or excess inventory refers to items that have diminished demand and are thus in danger of becoming obsolete down the line, mostly because they are overstocked, for instance, because of poor demand forecasting.

Obsolete inventory accounting

If not properly managed, obsolete inventory can present serious challenges to a company’s financial health. Inventory that cannot be sold or used ties up capital and may adversely affect key financial metrics such as the inventory turnover ratio.

Failing to account for obsolete inventory accurately can result in overstated profits and assets on financial statements. The Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) both mandate companies to address inventory obsolescence as soon as it’s recognized to ensure accurate and timely financial reporting. On a lighter note, GAAP allows for tax deductions on obsolete stock if sold, donated, or destroyed.

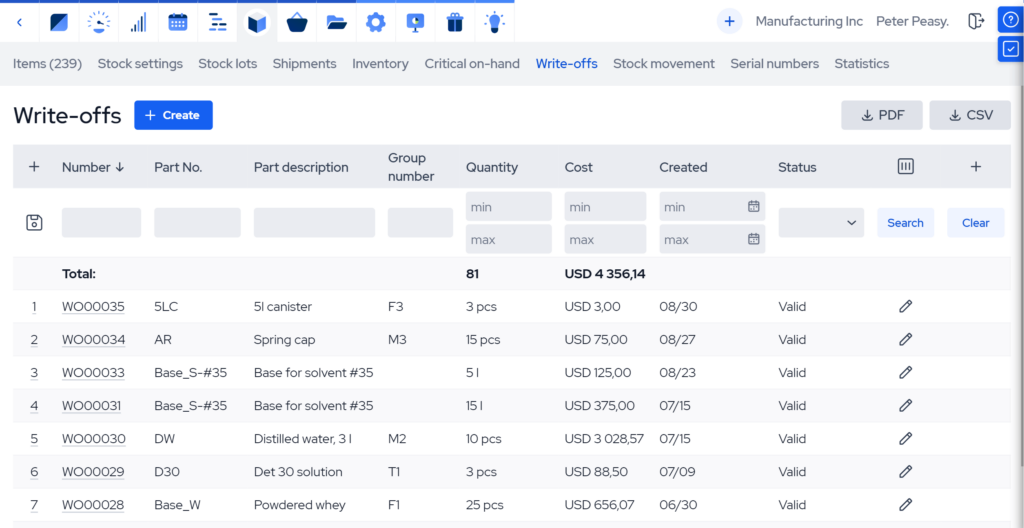

When detected, obsolete inventory must be marked as either a write-off or a write-down. A write-off is when stock is eliminated from the books altogether due to losing all realizable value. A write-down, on the other hand, means revaluing inventory to its net realizable value (NRV) – the lowest cash value that the asset can be sold for, after costs of sales, which is usually lower than its procurement cost.

Write-offs and write-downs are considered non-cash expenses and thus need to be debited to an expense account, such as the cost of goods sold (COGS) or obsolete inventory account. This reduces net income, decreases cash flow, and affects financial metrics. Write-downs and write-offs also reduce the value of assets on the balance sheet.

Common causes of inventory obsolescence

Obsolete inventory can result from many issues, from poor inventory management and a lack of traceability to unexpected market dynamics, supply chain issues, or even bad luck. Let’s review some major causes.

Bad quality or product design

Products that do not meet customer expectations or functional standards are more likely to lose demand. For example, if a company produces devices with a design flaw that causes frequent malfunctions, these items lose market value due to negative reviews and frequent recalls.

Poorly designed products don’t align with consumer preferences or needs and become outdated faster. This can contribute to an accumulation of obsolete stock and also affect the company’s reputation.

Inaccurate forecasting

Demand forecasting gone wrong is a leading cause of inventory obsolescence, as overestimating market demand inevitably leads to excess inventory. On the flip side, underestimating demand equals missed sales opportunities. Accurate demand forecasting is essential to balancing inventory levels with market needs, thus preventing obsolescence and minimizing financial losses.

But surprisingly, underestimating demand can also increase the risk of obsolescence. Missed sales opportunities often prompt production managers to overcompensate for future orders.

Inadequate procurement policies

Even if the forecasts are balanced, poorly managed procurement often fails to align purchasing decisions with actual market demand. Inventory can pile up when companies overstock goods tempted by bulk discounts or gut feeling. This, in turn, ties up valuable capital, drives up holding costs, and increases obsolescence risk.

Another hurdle is managing lead times. If not sufficiently tracked, the ordered stock might arrive too late to meet the initial demand, causing it to sit unsold and eventually become obsolete. These procurement inefficiencies can create vicious cycles of poor inventory control, where stock levels are perpetually misaligned with customer demand.

Poor inventory management and traceability

When inventory levels are not monitored, stock can get lost and unaccounted for in the warehouse. Insufficient inventory management often leads to overstocking, elongated lead times, and slow-moving items accumulating unnoticed. Without proper tracking, it’s difficult to identify which products are nearing the end of their life cycle, making it challenging to take timely actions like discounting or liquidating excess goods.

The lack of traceability within the rest of the supply chain can make the problem even worse. If inventory isn’t tracked from procurement to sales, the likelihood of items or orders being forgotten, passing their expiration dates, or missing their optimal sales window increases.

Market externalities

Market externalities and supply chain fluctuations can also lead to inventory obsolescence, often in difficult-to-predict or control ways. Sudden changes in consumer preferences, economic downturns, or the introduction of new technology can render existing products obsolete almost overnight.

Supply chain disruptions, like delays or raw materials shortages, can also lead to obsolescence. If a company receives materials too late to capitalize on a trend, the finished products might well miss their market window. Globalization and increased competition are accelerating product life cycles, making lean warehouse management practices more important than ever.

Examples of obsolete inventory

Identifying obsolete inventory falls on the companies themselves because manufacturing processes, market requirements, and the nature of products can vary greatly. For this reason, effective inventory tracking is crucial to modern manufacturing and distribution operations.

Here are a few examples of how obsolescence can occur.

- Damaged or defective products. During quality control, an electronics manufacturer discovers that a number of finished devices have faulty mainboards that cannot be repaired or replaced. These devices can’t be sold at their designed value but can be sold in bulk to an electronics recycling company. The company writes down the devices as scrap.

- Forgotten and expired inventory. A pharmaceutical company stores a large quantity of vaccines in its warehouse. Due to poor inventory management practices, the stock is forgotten and left in storage. When the inventory is finally reviewed at the end of the year, the vaccines are discovered to have exceeded their expiration date. Since expired medical products cannot be legally sold, the entire batch must be written off as obsolete inventory. What’s more, the company needs to spend further on hazardous waste disposal of the batch, worsening the financial burden of the situation.

- Failed demand forecasting. A fashion retailer predicts that a particular style of winter coats will be highly popular during the upcoming season and orders a large quantity. However, due to a larger competitor’s unexpected flash sale and a warmer winter, demand for the coats turned out much lower than anticipated. Since the coats are unlikely to be sold in the next season due to changing fashion trends, the retailer’s only option is to make a write-down and sell the products with a considerable loss so as to avoid total obsolescence.

Managing obsolete inventory

Obsolete inventory can be very detrimental to a company. It ties up capital, takes up storage space, accumulates overhead costs, increases administrative load, and more. All this is on top of the initial cost of procuring or manufacturing the goods.

It is important to manage dead inventory when it occurs. By far the best strategy to deal with obsolescence, though, is to prevent it from happening in the first place.

How to detect, prevent, and reduce obsolete inventory?

- Conduct regular cycle counting and stocktakes. Some obsolescence is inevitable. But regular inventory audits and cycle counting help you catch obsolete inventory before it becomes a larger issue. These practices help identify slow-moving or stagnant items early on, giving time to determine the next course of action.

- Enhance demand forecasting accuracy. As we’ve seen, accurate demand forecasting is foundational in preventing inventory obsolescence. Various tactics exist for increasing forecasting accuracy, like analyzing historical sales data, seasonality, and market trends or utilizing advanced forecasting tools. Regularly reviewing market conditions, maintaining good supplier relationships, and adjusting procurement strategies accordingly also contribute to more accurate forecasts.

- Design products with cyclical life cycles. Products designed with a planned obsolescence cycle in mind also reduce the risk of obsolete inventory. Modularity is another big trend in manufacturing. Modular design enables components to be reused or upgraded, extends product life, and helps minimize environmental waste. If modularity is not an option, designing for disassembly can also help.

- Ensure inventory visibility across all channels. Real-time stock visibility ensures that inventory levels are consistent and appropriately managed across different platforms and locations. Traceability helps to avoid over-ordering, increases lead time accuracy, and helps plan and schedule production, thus contributing to more accurate forecasts.

- Utilize inventory management software. Advanced inventory management software or manufacturing ERP systems are essential for tracking inventory, forecasting demand, identifying slow-moving items, and streamlining procurements. They provide real-time data and insights that enable businesses to make informed decisions, reducing the risk of overstocking and inventory obsolescence.

How to reduce and get rid of obsolete inventory?

No matter the effort, preventing obsolete inventory altogether is nearly impossible. Forecasts can only be so accurate; some goods can go out of fashion abruptly; new regulations may suddenly render products unsellable. Things can happen. Here are some ideas for what to do when they do.

- Remarketing. Explore alternative markets or channels where the obsolete inventory may still have value. This could involve selling to discount retailers, rebranding the product for a different audience, finding markets in other regions, etc. Remarketing can help recover some of the value from goods that would otherwise be written off.

- Promotions and discounts, clearance sales. Running clearance sales or offering deep discounts can help move obsolete inventory quickly. Promotions such as buy-one-get-one-free deals or flash sales can attract bargain hunters and clear out excess stock. While selling at a loss, this can still greatly alleviate the collateral that obsolescence often entails.

- Bundling. Combine slow-moving or excess stock with more popular products to create value-added bundles. This strategy can make the less desirable products more attractive to buyers by pairing them with desirable items. Bundling can be particularly effective when the obsolete items complement the more in-demand products.

- Liquidation partners and auction platforms. In many sectors, liquidation companies or auction platforms specialize in selling obsolete inventory in bulk. While the return on investment may be lower, liquidation offers a quick and efficient way to count the losses and dispose of large quantities of unsellable goods.

- Donate. If it’s clear the stock cannot be monetized but is still usable, donating obsolete inventory to charitable organizations or non-profits can be a socially responsible way to dispose of excess stock. This helps clear out inventory but may also provide tax benefits while enhancing the company’s community image.

- Repurpose or recycle. If the products or their components can be repurposed or recycled, this can be an effective way to recover some value. For instance, many parts from electronic devices can be reused in new products, or materials can be recycled to reduce waste and environmental impact.

If all else fails, write off obsolete inventory to minimize further financial losses. Then just wheel it to the scrap heap.

How can inventory management software alleviate obsolescence risk?

Inventory management software is a manufacturer’s or distributor’s best bet at reducing the risk of inventory obsolescence. It enhances forecasting accuracy and provides real-time visibility into stock levels. By leveraging historical sales data and market trends, these systems allow businesses to predict future demand more precisely, helping to avoid the pitfalls of misaligned procurements.

Modern software also offers detailed reporting capabilities that enable companies to make more informed decisions on inventory replenishment, stock levels, and production schedules, all of which are crucial for maintaining a lean and efficient inventory.

Efficient inventory management systems provide end-to-end traceability through leveraging barcode scanning, real-time job reporting, etc., allowing businesses to track every item from procurement to sale. The software is based on a perpetual inventory system that continuously updates inventory records as transactions occur. This is essential for identifying slow-moving items early on and enabling taking prompt action.

Moreover, the capable inventory software enables businesses to schedule production ahead of time, even when raw materials or components are still en route, ensuring that production timelines are met without accumulating excess stock. All these features help businesses reduce waste, minimize the financial impact of obsolete inventory, and improve overall operational efficiency. For example, MRPeasy integrates all of the above functionalities to support businesses in maintaining a streamlined and profitable inventory management process.

Key takeaways

- Obsolete inventory is stock that can no longer be sold or used due to diminished demand. It mostly stems from goods reaching the end of their product life cycle or sudden sales disruptions or demand forecasting mistakes.

- Accounting for obsolete inventory involves writing off or writing down unsellable items, which impacts the income statement by reducing net income and the balance sheet by lowering asset values.

- Common causes of inventory obsolescence include inaccurate demand forecasting, poor product design, inadequate procurement practices, and unexpected market or supply chain disruptions.

- Ways to prevent obsolete inventory include regular inventory audits, accurate demand forecasting, ensuring inventory visibility, and employing proactive procurement strategies.

- Inventory management software helps mitigate obsolescence risk by improving demand forecasting, offering real-time inventory visibility, setting optimal reorder points, and ensuring efficient stock tracking and traceability.

Frequently asked questions

Due to poor inventory management, a batch of vaccines was forgotten in storage and not used before their expiration date. Since expired medical products cannot be legally sold, the entire batch must be written off as obsolete inventory, resulting in both financial loss and additional disposal costs.

GAAP requires that obsolete inventory be accounted for as soon as it’s identified. This typically involves either writing down the inventory to its net realizable value or writing it off entirely if it has no value. These adjustments must be reflected in the financial statements promptly to ensure accurate reporting and tax deductions.

Inventory is generally considered obsolete if it can no longer be sold or used in production due to factors like expired shelf life, market changes, restricting regulations, zero demand, etc. Regular inventory audits, analysis of sales trends, and monitoring product life cycles can help determine when items are becoming obsolete and should be addressed.

You might also like: ABC Analysis (80/20 Rule) in Inventory Management